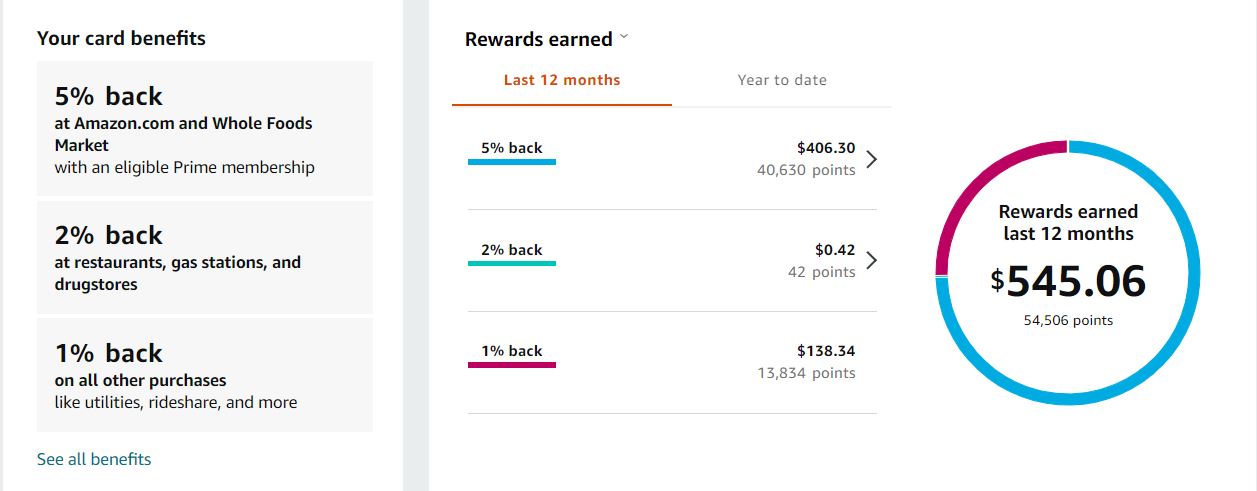

Forgot about my amazon card, 5% back.A little late but I'll chime in too...

We use 2 major CC's: Amazon for online purchases and my American Express Gold for everything in person, plus any travel or large consumer purchases. Amazon card has great cash back incentives, even on non-Amazon stuff. The Amex has slightly less rewards but has hugh protections - everything from automatic travel insurance to taking a return on an item that a store wouldn't accept. It has saved us thousands of dollars over the ~14 years that I've had the card.

Like most of you, our cards get paid monthly. Despite our modestly-high salaries, my wife and I aren't "big spenders". There are months where we spend a few $100 to a few $1000 more than normal, but it all averages out as there are months when we buy next to nothing other than the bare necessities. We have dedicated savings accounts, plus health savings accounts, and retirement accounts, as well as long-term "high yield" savings accounts (I use that term loosely since the interest rate is garbage) for things like vehicle purchases and big house stuff. For us, thankfully, CC's are a "positive" financial tool and not a burden.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Forgot about my amazon card, 5% back.

Yeah the Amazon purchases on the Amazon card adds up quick. This was just from this past year, which honestly has been lower than normal since we really haven't purchased much (knowing that we were moving) and we didn't do many gifts around the holidays (we paid for trips/events instead). Most of the purchases this year are stuff we would normally buy at a grocery store - cat and dog food, litter, paper products, etc.

The biggest reason to use credit cards over debit cards is liability. Second to that is getting something back from your purchases.

If I dropped my credit card I wouldn't sweat it for a second. On the other hand, if I dropped a debit card I'd be worried as hell! Literally all your cash in the account can be gone and you have to fight to get it back. All the while the other bills paying from account could be jeopardized. With a credit card, your using their money.

I use different credit cards for different purchases to maximize my returns. I use them for virtually everything because I like money. Returns can be hundreds to thousands of dollars depending on your spending habits.

Returns can be hundreds to thousands of dollars depending on your spending habits.

Credit cards take discipline for sure but they are a powerful tool. Try renting a car or motel with cash or debit card, you'll find that it takes a credit card.

I've had people say they don't like credit cards only to find out that they actually can't get one due to credit issues.

Never charge more than you can pay off in full before the due date. Set up alerts so you know whats going on during the billing cycle. Enjoy the rewards!

One last note, utilize www.annualcreditreport.com as you can get one free credit report per credit bureau once per year. Also pay attention to your credit score and credit to debt ratio.

If I dropped my credit card I wouldn't sweat it for a second. On the other hand, if I dropped a debit card I'd be worried as hell! Literally all your cash in the account can be gone and you have to fight to get it back. All the while the other bills paying from account could be jeopardized. With a credit card, your using their money.

I use different credit cards for different purchases to maximize my returns. I use them for virtually everything because I like money.

Credit cards take discipline for sure but they are a powerful tool. Try renting a car or motel with cash or debit card, you'll find that it takes a credit card.

I've had people say they don't like credit cards only to find out that they actually can't get one due to credit issues.

Never charge more than you can pay off in full before the due date. Set up alerts so you know whats going on during the billing cycle. Enjoy the rewards!

One last note, utilize www.annualcreditreport.com as you can get one free credit report per credit bureau once per year. Also pay attention to your credit score and credit to debt ratio.

Our advisor many years ago said to open up separate checking accounts - one specifically for bills and "autopay" stuff and don't "link" it to any others or to a card, then have a small one for cash/debit purchases as needed. He also said to never use a PIN for purchases (essentially use it like a credit card) since it will give you the benefits of a credit card. If you were to lose it AND have your PIN compromised, you're screwed for sure...On the other hand, if I dropped a debit card I'd be worried as hell! Literally all your cash in the account can be gone and you have to fight to get it back. All the while the other bills paying from account could be jeopardized. With a credit card, your using their money.

5632

Love me some Target!!!

Ha ha! That was the LEAST fucked up thing she did.wowI'd of kicked her so hard between the legs id of lost a shoe ! guess thats why I never got married

That divorce cost me well over half a million all told. It would have been worth it at twice the cost.

My life now is about as beautiful as it gets!

5632

Love me some Target!!!

I is cheaper to beery them than it is to devoice them.Ha ha! That was the LEAST fucked up thing she did.

That divorce cost me well over half a million all told. It would have been worth it at twice the cost.

My life now is about as beautiful as it gets!

Bighammer

TJ Enthusiast

Lol, same here. I always figured that my client would have a visa / mc card in their wallet: and they always do. As a merchant there’s a bigger hit to accept AmEx or Discovery.As a merchant for 45 years I would never, never accept Discover or American Express credit cards. And would never have for myself today.

ATM card is for pulling out pocket money from my bank’s ATM only. When I’m traveling out of the country I have a separate account and card that I use to get the best local exchange rate and it has a set amount in case of a compromise.

Credit cards for all purchases. I have both United and American cards for the miles. I only pay for flights if I have to fly a different airline. Both airline cards get me on the plane early and access to the vip lounge which is a nice perk. Also rental car coverage and the ability to dispute a charge if needed. The down side is going through the statements to look for scam charges which I’ve found a few over the years. When I make a large purchase such as a vehicle or large equipment I use a card unless they charge a surcharge which usually is after $5K. When I bought my Kubota tractor I got 2 domestic tickets out of the deal with no surcharge. The trick is to always pay of a card every month to avoid interest. The down side to CC use is that my travels can be seen and tracked by the Man.

Credit cards for all purchases. I have both United and American cards for the miles. I only pay for flights if I have to fly a different airline. Both airline cards get me on the plane early and access to the vip lounge which is a nice perk. Also rental car coverage and the ability to dispute a charge if needed. The down side is going through the statements to look for scam charges which I’ve found a few over the years. When I make a large purchase such as a vehicle or large equipment I use a card unless they charge a surcharge which usually is after $5K. When I bought my Kubota tractor I got 2 domestic tickets out of the deal with no surcharge. The trick is to always pay of a card every month to avoid interest. The down side to CC use is that my travels can be seen and tracked by the Man.

I once had a vendor give me $125,000 credit limit for the first job I ever gave them right out of the gate, then they let me pay it all off with a credit card with no extra fees...man I miss those days