Depends on what the residual number calculated into the lease contract is, which is what you can purchase it for at the end of the lease. I've also seen lease returns with negotiated purchases under residuals before. Happens often in the luxury market.You forgot the downfall that after paying ~$300-$400 a month for 3 years and then returning it, you have nothing to show for the $10,800 - $14,400 you paid Jeep.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Should I lease a Jeep?

- Thread starter chloe

- Start date

Really? Reviving a thread from 3 years ago where the OP has 1 post?

I don't think he'll ever see any of the responses

I don't think he'll ever see any of the responses

Just for fun thread.Really? Reviving a thread from 3 years ago where the OP has 1 post?

I don't think he'll ever see any of the responses

Starrs

TJ Guru

When leasing a wrangler your gonna have to have money down also lol. I just don’t get why people want to rent a vehicle. You can’t do anything to it, you have to watch your miles.

Just for fun thread.

I think I'm wondering how it is someone found it from 3 years ago

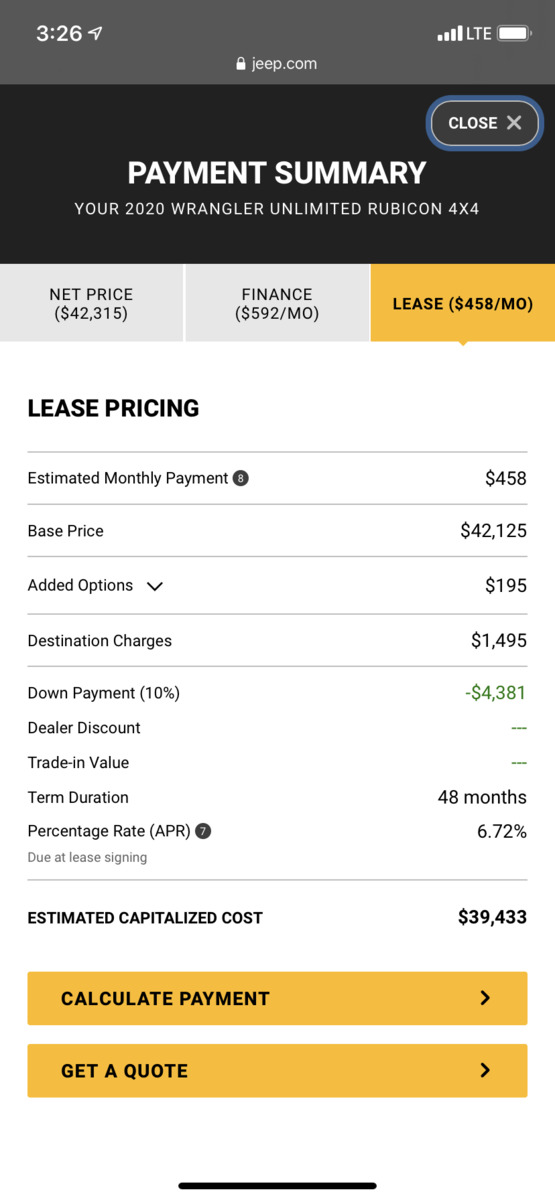

When leasing a wrangler your gonna have to have money down also lol. I just don’t get why people want to rent a vehicle. You can’t do anything to it, you have to watch your miles. View attachment 152543

The same reason people cross shop Wranglers with Honda Pilots and Toyota Highlanders.

You keep thinking of them as toys like we do. To the majority of people, they are replacement SUVs.

What's even funnier is that they member that revived it only has 1 post too.I think I'm wondering how it is someone found it from 3 years ago

Rubicon John

TJ Enthusiast

Irrelevant considering those who lease vehicles want to get a new one every 3 years or so.You forgot the downfall that after paying ~$300-$400 a month for 3 years and then returning it, you have nothing to show for the $10,800 - $14,400 you paid Jeep.

OHFIVETJ

TJ Addict

BUT on the other hand, DON'T be so ignorant as to say you have nothing to show for it, when not thinking through all the advantages that out weigh the disadvantages in the overall picture. LOOK at the overall picture NOT the narrow tunnel in front of you. Approx 30% of the vehicles on the road are leased. The ones there are not leased, either drive too many miles, don't get any write offs, don't want to be stuck for 3 yrs & the others just DON'T understand & way too stubborn to listen. ( CURIOUS ? how is it you get PHUCKT everytime ? )You can debate how leasing a vehicle always works out, but when you turn that depreciating asset back in after your done test driving it for 3 years you get absolutely nothing back. You get fucked Everytime. People should just save their money and have a good down payment to finance

Last edited:

Rubicon John

TJ Enthusiast

I just get another one! Even better than the last one every time.You can debate how leasing a vehicle always works out, but when you turn that depreciating asset back in after your done test driving it for 3 years you get absolutely nothing back. You get fucked Everytime. People should just save their money and have a good down payment to finance

Maybe he wants to lease a TJ

I smell an instigator, lol.Maybe he wants to lease a TJ

OHFIVETJ

TJ Addict

When leasing a wrangler your gonna have to have money down also lol. I just don’t get why people want to rent a vehicle. You can’t do anything to it, you have to watch your miles. View attachment 152543

1. You DON'T have to put anything down, just like a finance / loan, with good credit. You just have a higher payment.

2. I already stated miles requirements as one of my 2 pitfalls upfront ...........

LETS NOT FORGET - when you finance it your "RENTING" it too, & for a hell of a lot longer 5, 6, & even 7yrs vs 3yrs

( the bank owns it NOT you ) ⚠ ⚠

oh..........and NOT EVERYONE wants to do anything to it ? TUNNEL vision at it's best.

One way thinking inside the box !

Stated my case, don't want to "DEBATE" 1/2 full or 1/2 empty / done

Last edited:

Starrs

TJ Guru

Lol if you want to live with a car payment for the rest of your life a lease he definitely the way to go. Do you get that down payment back that you have to give at lease signing? Also when you turn said lease in is it true that any repairs the stealership sees fit have to be out of your pocket? Yea I like to pay my vehicles off and not have the payment myself. Leasing is a quick fix for somebody...that ain’t me hahaBUT on the other hand, DON'T be so ignorant as to say you have nothing to show for it, when not thinking through all the advantages that out weigh the disadvantages in the overall picture. LOOK at the overall picture NOT the narrow tunnel in front of you. Approx 30% of the vehicles on the road are leased. The ones there are not leased, either drive too many miles, don't get any write offs, don't want to be stuck for 3 yrs & the others just DON'T understand & way too stubborn to listen. ( CURIOUS ? how is it you get PHUCKT everytime ? )

A lease is great for the uninformed. Financially speaking, a lease is almost always the worst of the two choices.Lol if you want to live with a car payment for the rest of your life a lease he definitely the way to go. Do you get that down payment back that you have to give at lease signing? Also when you turn said lease in is it true that any repairs the stealership sees fit have to be out of your pocket? Yea I like to pay my vehicles off and not have the payment myself. Leasing is a quick fix for somebody...that ain’t me haha

It’s also safe to say that anyone getting into a new car every 3 years or so, is making a poor financial decision.

Starrs

TJ Guru

Lol higher payment with nothing to gain. Sign me up1. You DON'T have to put anything down, just like a finance / loan, with good credit. You just have a higher payment.

2. I already stated miles requirements as one of my 2 pitfalls upfront ...........

LETS NOT FORGET - when you finance it your "RENTING" it too, & for a hell of a lot longer 5, 6, & even 7yrs vs 3yrs

( the bank owns it NOT you ) ⚠ ⚠

Stated my case, don't want to "DEBATE" 1/2 full or 1/2 empty / done

Nimbley

TJ Enthusiast

I always thought leasing a vehicle was an incredibly dumb thing to do but I refuse to have car payments. If I can’t buy it outright I can’t afford it. New also. I’ll let someone else pay the depreciation and shop for a good used one. I don’t understand paying $50k for a shiny new vehicle and then it immediately looses $10k when you sign the papers and the wheels leave the lot.

As a CPA, I get asked this question all the time by clients. The ONLY time leasing works out better financially is for a business vehicle that is going to get traded back in every 3-4 years anyways.

Rubicon John

TJ Enthusiast

Modern vehicles are full of unneeded items, even just the ones that make them run.Lol if you want to live with a car payment for the rest of your life a lease he definitely the way to go. Do you get that down payment back that you have to give at lease signing? Also when you turn said lease in is it true that any repairs the stealership sees fit have to be out of your pocket? Yea I like to pay my vehicles off and not have the payment myself. Leasing is a quick fix for somebody...that ain’t me haha

My lease payment is simply added to my monthly budget. Much like a cable bill or any other luxury I don’t really need but enjoy having.

The peace of mind knowing that my wife has a safe and reliable car to drive is well worth always having that payment. Maintenance and roadside assistance including free tows is included.

if her car breaks it gets dropped off at the dealership, a loaner provided, and we get a phone call when it’s ready.

I’ve also seen the build quality on cars nowadays. After 4 or 5 years they start to wear out. Most cars aren’t built for any sort of long term ownership. I don’t want to own a product long term that wasn’t engineered to be reliable, but simply to make a profit.

I don’t put down payments on leases. And you sign off on damages/wear and tear when you turn it in so there are no surprises.

The best financial play to still accomplished what you described is consider buy/lease a vehicle that has just come off a 24-36 month lease. I purchased a certified pre-owned vehicle (Acura) and the extended warranty included from Acura was better than the initial new car warranty. You can also lease these pre-owned vehicles for a lot less than new.Modern vehicles are full of unneeded items, even just the ones that make them run.

My lease payment is simply added to my monthly budget. Much like a cable bill or any other luxury I don’t really need but enjoy having.

The peace of mind knowing that my wife has a safe and reliable car to drive is well worth always having that payment. Maintenance and roadside assistance including free tows is included.

if her car breaks it gets dropped off at the dealership, a loaner provided, and we get a phone call when it’s ready.

I’ve also seen the build quality on cars nowadays. After 4 or 5 years they start to wear out. Most cars aren’t built for any sort of long term ownership. I don’t want to own a product long term that wasn’t engineered to be reliable, but simply to make a profit.

I don’t put down payments on leases. And you sign off on damages/wear and tear when you turn it in so there are no surprises.